Debt Collection System For Companies In SAUDI ARABIA

Debt collection using high-quality software that automates the whole process is a modern-day requirement and necessity to businesses, corporates, and people in Qatar. The earlier methods of Debt Collection was tedious that created lot of heat among competitive businesses and corporates. It was due to friction that kept happening in manual debt collection processes, which also maimed professional and personal relationships within several societies and communities. As a solution to this old age conundrum, Debtics developed software that automates the debt collection process with which businesses started navigating through smooth waters and simplified techniques brought about by technological innovations. Businesses in Qatar have become the biggest benefactors of the Debt Collection Software developed by Debtics. The automated debt collection process becomes essential for businesses. This is because the companies tend to lose billions of amounts each year due to inadequate adoption of debt collection technology for outstanding-payments collection. The collaborative software of Debtics serves as the perfect platform that automates and simplifies the entire debt collection process in Qatar. With the software, one can automate, optimize, and measure all the outstanding dues or debts and its risks. Once the customized report is ready, the debt collections and legal procedures get done efficiently by an in-house debt-collection team. The software allows the debt to be collected through online payment gateways as well, which is convenient for businesses in Qatar.

The debt collection software of Debtics gives businesses the much needed breathing space to collect debts while doing so in a reduced budget. Debt collection software automates the process by which it deals with clients directly without any human intervention. In cases where humans need to get intervened, the software provides notifications, alerts, and customized reports that optimize the entire debt collection process for the businesses in Qatar. Debtics provide many features along with debt collection process, which becomes a necessity to drive the businesses without much financial damage. The software gets maintained properly as Debtics focus on improving the debt-collection rate in an easy way without damaging reputation.

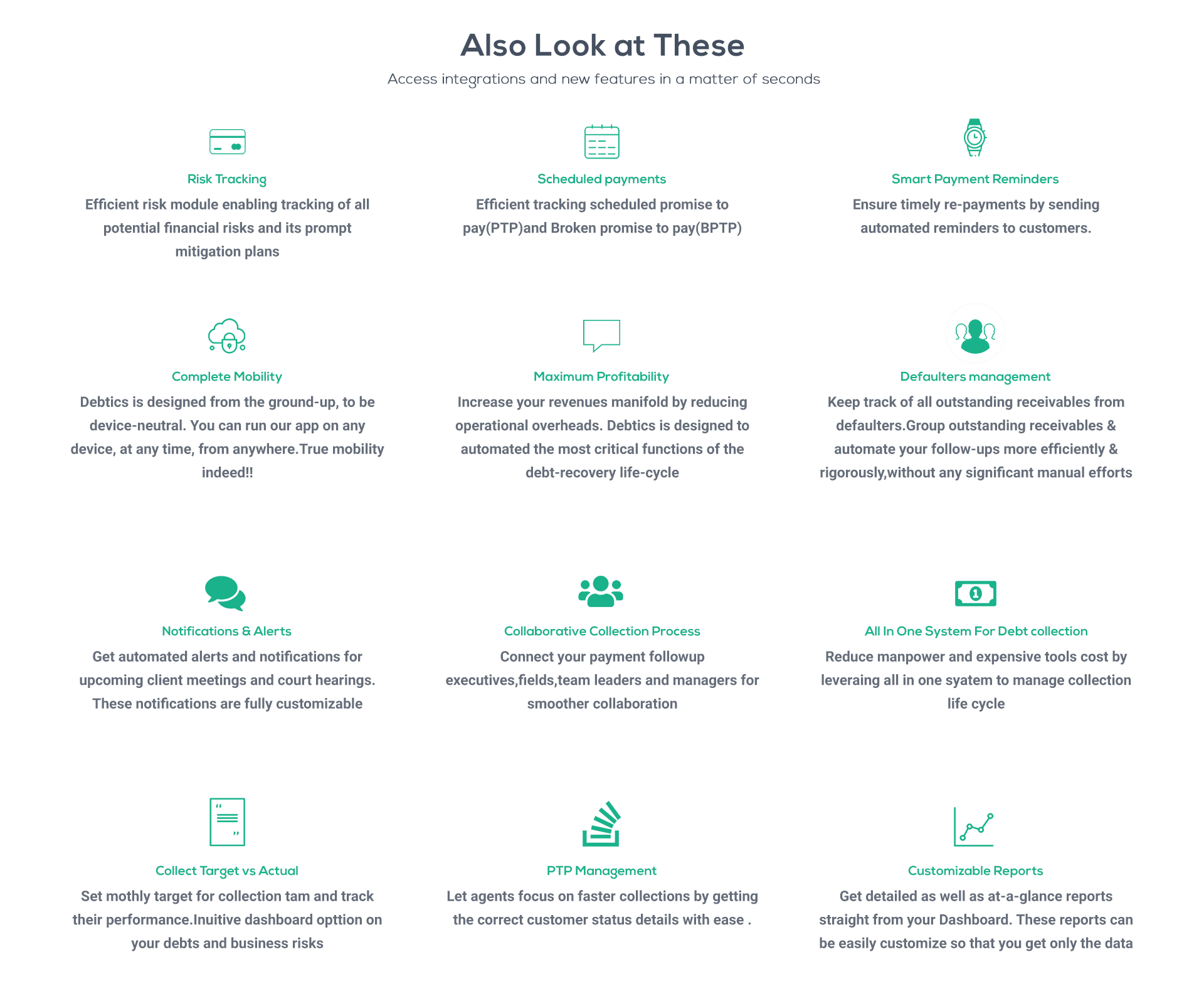

The production of customizable action-plan, blueprints, and debt-collection reports gets aligned with the business requirements, which is essential for businesses in Qatar. Through a collaborative platform, Debtics software that is customized to the business needs enables a faster and easier debt collection experience unlike the olden days. The software helps to automate, optimize, and measure all outstanding dues and its risks while legally collecting the debts from concerned people. As the software is customized through risk tracking, scheduled payments, smart payment reminders, complete mobility, maximum profitability, defaulters’ management, notifications, alerts, PTP management, and customizable reports, the company saves a huge amount of financial transactions that can be used elsewhere.

The automation benefits include the intelligent use of financial resources to drive the business forward while generating revenue and increasing profitability while collecting debts through the software.

Yes. It is completely scalable as per your business needs as we understand the importance of debt-collection through our software. The debt collection software used in Qatar by Debtics is one of the advanced and high-quality software that improves your debt-collection process in a faster, optimized, and streamlined way as possible.

From initial contact to receiving payment, Debtics software enables a faster and easy debt collection experience. Automate, optimize and measure all of your outstanding dues risks, collections and legal processes by your in house collection team much efficiently.

Businesses from SME to corporate lose billions of amount in every year due to inadequate adoption of debt collection technology for outstanding payments collections. Many companies are struggling to collect outstanding receivables from their clients and thereby