Debt Collection System For Companies In SAUDI ARABIA

Debt collection software is aired with outstanding functioning capacities that will surprise the user. Firstly, it is a panoramic companion for labour-saving debt accumulation management. It will upgrade the collection tactics and equip the collector to invest more focus on proceeding activities and phone calls with accurate information. Secondly, It motorises the functioning of the collection. This is to locate all accounts in our departments and to secure all debt information and data in a single place. Thirdly, this makes the import of mechanising files. By this, we can locate and track the debt recovery data.

The collection of debt in Saudi Arabia according to the principles laid down in the Sharia law, embodies the shadowing of unpaid debt from people. Deep knowledge is required for accumulating debt in Saudi Arabia, because of the complex system. Abiding by these laws boosts efficiency in debt recovery, imparts fairness, regulates trust and unifies financial transactions. Saudi Arabia had a civil court that relied fully on Islamic principles. It furnishes a patterned pathway for deliberate resolution and legal debt General courts, commercial courts and Supreme courts are the three-tier civil dais system in Saudi Arabia. Having a solution with extensive knowledge of the laws and regulations of the courts that ensure outstanding and lawful matters is the mantra to be on good terms with debt recovery.

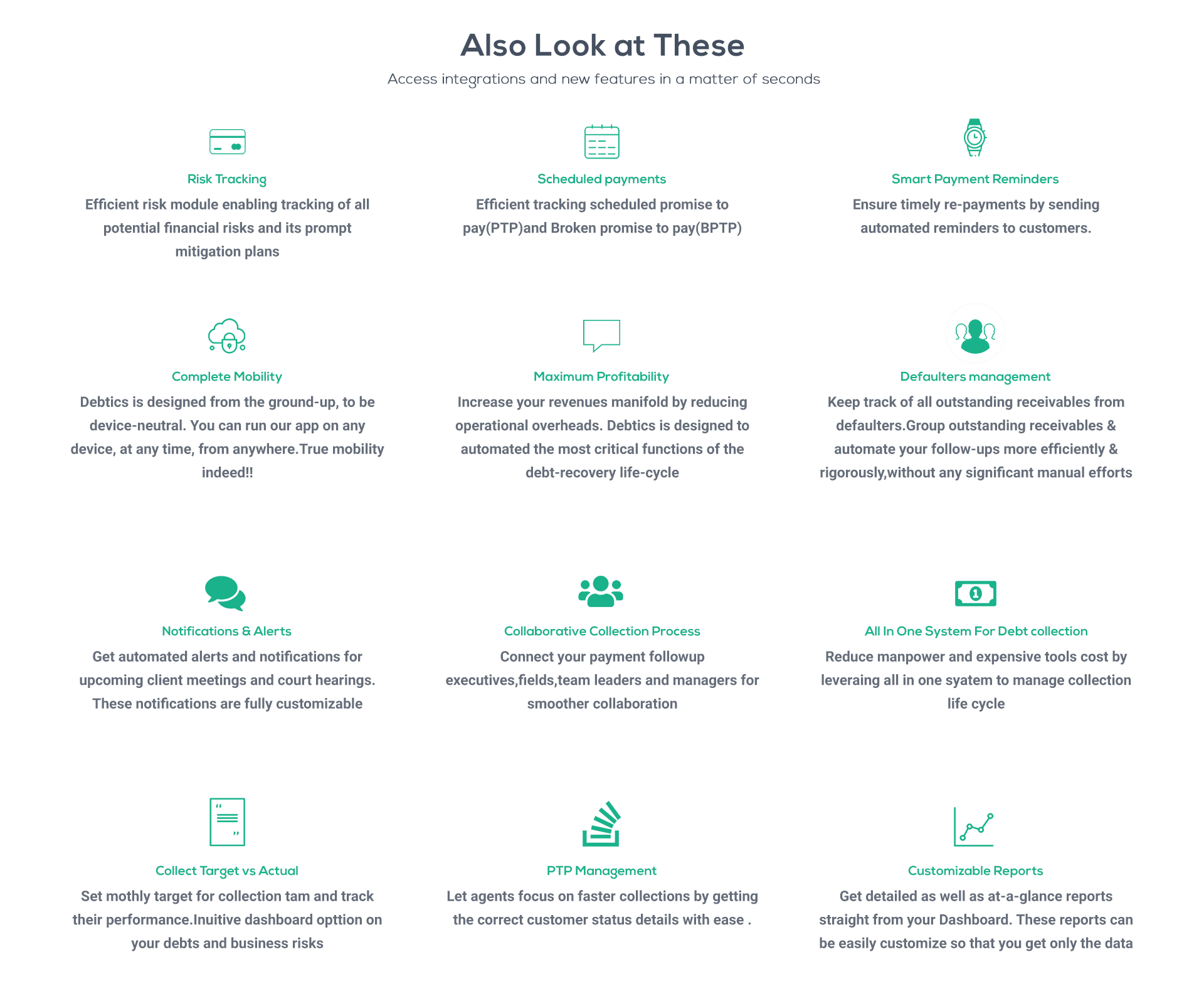

Businesses in Bahrain can rely on our debt collection software at Debtics as we simplify your debt collection worries. Debtics use technology, automation, and innovation to simplify the debt collection processes. This has resulted in businesses gravitating towards using one of the best debt collection software in Bahrain. For corporate debt-collection departments, Debtics utilize the enabling of a systematic debt collection process with automated reminders for upcoming and delayed payments. Debtics sets up efficient payment follow-ups and settlement tracking as well. Corporate risk tracking and dispute management are hallmarks of Debtics, which gets used through the customized debt collection software. Along with managing debt collection with ease, Debtics offer great packages that include invoice recovery, corporate recovery, and tools and ways to access integrations and new features within a matter of seconds. These features bolster the credibility of debt collection software and Debtics, which is popular among businesses in Bahrain. Data gets stored in secure ways within the debt collection software of Debtics, which is a necessary criterion to inculcate trust within clients and customers.

There were innumerable advantages to the selection of software mechanisms other than the traditional methods in Saudi Arabia. The prime reason behind this adoption is because of the rising recovery rates. Updated algorithms and analytics based on the principle of prediction will emit succour to point out an accurate account at the right time, thereby elevating the recovery rates. Secondly, It is resourceful for the choice of electronic instalment plan. Brilliant software offers boundless cooperation of computerised instalment plans. Thirdly, decrease the level of outbound call noises. It helps the users to use organised communication and self-service methods. Fourthly, it delivers a collection based on prediction for proactive strategies.

Even though debt-collection software seems to be the best option for debt-collection mechanisms, it has its boundaries. Certain debts cannot be favoured by the software in Saudi Arabia. The platforms assemble all unpaid debts vehemently in Saudi Arabia. This software platform is an excellent one that flexibly ,reliably, accurately shifts all the long-delayed invoices to the gathering agencies and financial obligation departments. It furnishes elevated price levels efficiently and shortens the management challenges of the agents. The software efficiently executes outstanding payments like financial dues and pending invoices. And there is no need here to do the ordinary and mundane optimisation of importing data and data regulation checks which makes the convenient and quick use of the technology.

From initial contact to receiving payment, Debtics software enables a faster and easy debt collection experience. Automate, optimize and measure all of your outstanding dues risks, collections and legal processes by your in house collection team much efficiently.

Businesses from SME to corporate lose billions of amount in every year due to inadequate adoption of debt collection technology for outstanding payments collections. Many companies are struggling to collect outstanding receivables from their clients and thereby